Knowing and understanding the proper terminology within the forex market is essential in becoming a successful trader. In this article we discuss and define what are Forex pips, lots, margin and leverage?

Pips and Lots

Currency traders quote the value of a currency pair, and trade sizes, in pips and lots.

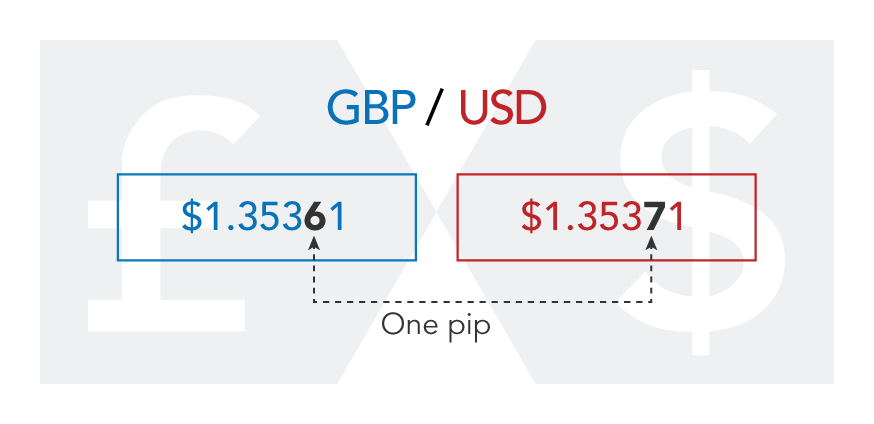

The term pip stands for “percentage in point”. It is the minimum price movement in the Forex market.

A pip is usually the smallest amount by which the value of a currency pair can change. Nearly all currency pairs consist of five significant digits and most pairs have the decimal point immediately after the first digit.

In example, when the value of the GBP/USD pair goes up by one tick (i.e. pip) the quote will move from 1.3536, to 1.3537, and the size of the movement is just one pip.

An important guideline for the beginning trader is to measure success or loss in an account by pips instead of the actual dollar value. A one pip gain in a $10 account, is equal, in terms of the trader’s skill, to a 1 pip gain in a $1,000 account, although the actual dollar amount is very different.

The smallest size in currency trading for professional traders is called a lot. For USD-based pairs, the lot size is 100,000. In other words, when you enter a trade with your margin account, the smallest amount that you can buy or sell is 100K, regardless of the size of your margin.

Margin and Leverage:

Another important concept in currency trading is the twin phenomenon of margin and leverage. This is a concept that carries a high degree of risk, but since forex prices move very slowly (in terms of the actual change in value), the vast majority of traders leverage their accounts when engaging in short-term trading.

When you open a forex account, the broker will request that you deposit a small sum, known as margin, as insurance against the losses that your account may suffer. With this small sum, you’re able to control a much larger amount, enabling greater gains, but also greater losses than you would be able to achieve with your deposit. It’s easier to understand margin and leverage in the context of a borrowing process. The lots that you can trade are borrowed from your broker, who requires a margin deposit as an insurance against losses. The ratio between the funds borrowed by you, and the margin that you deposit as insurance is called leverage. Thus, if you set a leverage ratio of 100:1, enabling the trade of 1,000,000 USD with just 10,000 USD in deposit, but eventually trade just 100,000, the actual leverage that you would be using is 10:1.

In order to understand how to manage your account you must gain a good understanding of leverage. Failure to pay proper attention to leverage and margin may result in a margin call and the broker may liquidate your position in order to ensure that your losses do not reach a level where your margin deposit is insufficient to cover them. Increasing leverage = increases risk.

Read more: Forex trading tips for Beginners

These people cannot process a withdrawal I invested $45,579.00 with the broker wise banc and won a bonus of $156,834.000 I wanted to make a withdraw and they can’t process it, I have been trying to get my money out since mid- July 2018. I have given them all my banking information: routing number, acct number … and they cannot manage to produce the withdrawal. I kept getting messages saying they are working on it, I wasn’t able to withdraw my money from the account, thought I was not gonna see this day but God so kind. I was able to get solution to my withdrawals issue with my broker wise banc with the help of a recovery expert Mr Ethan Zachary, whom was recommend on the broker reviews, who helped me recover my funds including my bonus, I would not trust wisebanc to ever make my withdrawal go through so I had to seek help elsewhere and they already closed my account. They seem dishonest, I am happy I could get back my money from them, I advise everyone out there to be very careful with the brokers they invest their money with, in case you are reading this and you are already a victim of this fake binary broker, there’s still hope to recover your funds, feel free to reach out to Mr Ethan Zachary via his email address:ethanzachary516@gmail.com and he will guide you on a simple step to take and get back your investment.

⚫️ ALL YOU NEED TO KNOW ABOUT LOST FUNDS RETRIEVAL ⚫️

⚫️ These days you have to be very careful about who you contact for Funds Retrieval because most of these companies out there who claim they are funds recovery experts are not really who they claim they are, especially those that spam comment sections with their gmail, they are as wack as the scammers who took your money in the first place. come to think of it, why would a Legit Firm be using an ordinary gmail instead of a professional email address. If you’ve had encounters with these guys, you’ld appreciate this Write up..

⚫️ Truth be told, the only firm capable of retrieving your lost funds from online scams, fraud and scam investment websites are Team of PROFESSIONAL HACKERS & CYBER FORENSIC EXPERTS, they are the ones who knows various Retrieval Techniques and Strategies that suits different scenarios of Scam. Some companies would tell you they would make use of their Lawyers and Law enforcement Agencies to fight your scammer, all these are long and time wasting procedures and this might eventually not work out or even result in more losses. If you are smart enough, you should know that online scam recovery is a very Professional Case that requires Professional Handling by EXPERTS in the field. You have to take a bold and SMART step by consulting a team of Highly Ranked Hackers and Cyber Forensic Experts Today At FUNDS RETRIEVAL PANEL

⚫️ http://www.fundsretrievalpanel.com ⚫️

Investment is one of the best ways to achieve financial freedom. For a beginner there are so many challenges you face. It’s hard to know how to get started. Trading on the Cryptocurrency market has really been a life changer for me. I almost gave up on crypto at some point not until saw a recommendation on Elon musk successfully success story and I got a proficient trader/broker Mr Bernie Doran , he gave me all the information required to succeed in trading. I made more profit than I could ever imagine. I’m not here to converse much but to share my testimony; I have made total returns of $10,500.00 from an investment of just $1000.00 within 1 week. Thanks to Mr Bernie I’m really grateful,I have been able to make a great returns trading with his signals and strategies .I urge anyone interested in

INVESTMENT to take bold step in investing in the Cryptocurrency Market, you can reach him on WhatsApp : +1(424) 285-0682 or his Gmail : BERNIEDORANSIGNALS@GMAIL.COM, bitcoin is taking over the world, tell him I referred you

it was a success, I got my lost funds recovered am happy to share my experience so far in trading binary options have been losing and finding it difficult to make a profit in trading for long, traded with different trading companies but I couldn’t earn profits and I ended up losing the whole live-saving I gave up on trading until I meet [Raymond Susy ] who help me and gave me the right strategy and winning signals to trade and earning process and also I was able to get all my lost fund back from all the brokers and trading companies I traded with, now I can make profits anytime I place a trade through her amazing masterclass strategy feel free to email her on mail {Raymondsusy39@gmail.com} her WhatsApp contact +351964978799

Investing online has been a main source of income,that’s why knowledge plays a very important role in humanity,you don’t need to over work yourself for money.All you need is the right information,and you could build your own wealth from the comfort of your home!Binary trading is dependent on timely signals,assets or controlled strategies which when mastered increases chance of winning up to 90%-100% with trading. It’s possible to earn $10,000 to $20,000 trading weekly-monthly,just file a complaint with Robert,I had almost given up on everything about binary trading and ever getting my lost funds back,till i met with him,with his help now i have my lost funds back to my bank account and I can now trade successfully with his profitable strategies and software!! Email: Robertseaman939@gmail.com or whatsApp: +44 7466 770724

I finally found an account manager about which for the first time in 5 years I will write a positive review. Mrs Ashley really showed its good side. This is both reliability in the execution of orders, and professional consultants who will always come to the rescue if force majeure suddenly happened on the market, I have no complaints about her trading platform, it works perfectly and does not freeze. With the depositing and withdrawal of funds in general there is no problems, everything comes on time. And of course, webinars which are conducted very often, for beginner traders and if you want to recorver your lost funds – I recommend Mrs Ashley, although for those with experience too. In general, for four months I have no complaints about the platform. you can whatsapp her on +447859834586 Email. ( ashleyraymond070@gmail.com )

Please everyone should be careful and stop being deceived by all these brokers and account managers, they scammed me over $50,000 of my investment capital, they kept on requesting extra funds before a withdrawal request can be accepted and processed, in the end, I lost all my money. All efforts to reach out to their customer support desk had declined, I found it very hard to move on. God so kind I followed a broadcast that teaches on how scammed victims can recover their funds, I contacted the email provided for consultation, I got feedback after some hours and I was asked to provide all legal details concerning my investment, I did exactly what they instructed me to do without delay, to my greatest surprise I was able to recover my money back including my profit which my capital generated. I said I will not hold this to myself but share it with the public so that all scammed victims can get their funds back. Gmail: wizardwilliammitnickquick23@gmail.com.net or text him on WhatsApp +1 (559) 851-5537 he is very trustworthy.

The simple truth about binary options which many of us do not know is the fact that it is mainly based on predictions. Without proper knowledge of what next can happen to the stock market, you are sure to lose your funds. That is why it is important to be tutored or mentored by a professional trader in binary options. During the few days of being mentored by Mrs Doris Ashley I’ve learnt much and also succeeded in trades and has been doing successful withdrawals and was able to recover all my lost funds. Feel free to contact her on Dorisashley52@gmail. com or Dorisashley52@protonmail.com or WhatsApp her +351 968 942 567 for positive results

?? DO YOU WANT TO RECOVER YOUR LOST FUNDS ON BINARY OPTIONS AND BITCOIN INVESTMENTS??? OR YOU NEED A LEGIT HACKING SERVICE ?? TAKE YOUR TIME TO READ??????

☑️ The CYBER SECURITY SPECIALISTS have received numerous complaints of fraud associated with websites that offers an opportunity to buy or trade binary options and bitcoin investments through Internet-based trading platforms. Most Of The complaints falls into these Two categories:

1. ? Refusal to credit customers accounts or reimburse funds to customers:

These complaints typically involve customers who have deposited money into their binary options trading account and who are then encouraged by “brokers” over the telephone to deposit additional funds into the customer account. When customers later attempt to withdraw their original deposit or the return they have been promised, the trading platforms allegedly cancel customers’ withdrawal requests, refuse to credit their accounts, or ignore their telephone calls and emails.

2. ? Manipulation of software to generate losing trades:

These complaints allege that the Internet-based binary options trading platforms manipulate the trading software to distort binary options prices and payouts in order to ensure that the trade results in a Loss. For example, when a customer’s trade is “winning,” the countdown to expiration is extended arbitrarily until the trade becomes a loss.

☑️ Most people have lost their hard earned money through binary options and bitcoin investments, yet they would go to meet fake recovery Experts unknowingly to help them recover their money and they would end up losing more money in the process. This Is Basically why we (CYBER SECURITY SPECIALISTS) have come to y’all victim’s rescue. The clue is most of these Binary option brokers have weak Database security, and their vulnerabilities can be exploited easily with the Help of our Special HackTools, Root HackTools And Technical Hacking Strategies because they wouldn’t wanna spend money in the sponsorship of Bug bounty Programs which would have helped protect their Database from Unauthorized access to their Database, So all we do is to hack into the Broker’s Database via SQL Hook injections & DNS Spoofing, Decrypt your Transaction Details, Trace the Routes of your Deposited Funds, Then some Technical Hacking Algorithms & Execution Which we cant explain here would follow then you have your money recovered. ? ? ✔️✔️

☑️ We have a trained team of seasoned cyber security professionals under various skillsets when it comes to Hacking. Our company in fact houses a separate group of Hackers who are productively focussed and established authorities in different platforms. They hail from a proven track record and have cracked even the toughest of barriers to intrude and capture or recapture all relevant data needed by our Clients. Some Of These Hackers Includes,, JACK CABLE, ARNE SWINNEN SEAN MELIA, DAWID CZAGAN And More. All You Need to Do is to send us a mail and we’ll assign any of our available specialists to Handle your Job immediately.

☑️ CYBER SECURITY SPECIALISTS [CSS] is available for customer care 24/7, And You Can Also Contact us for other Technical Hacking Services you desire Such as:

* WEBSITE HACKING

* CREDIT CARD MISHAPS

* PHONE HACKING (giving you Unnoticeable access to everything Happening on the Target’s Phone)

* CLEARING OF CRIMINAL RECORDS

* SOCIAL MEDIA ACCOUNTS HACKING

☑️ CONTACT:

••• Email:

cyberdemonhacker432@gmail.com

Have you lost hope of ever recovering your money from scam brokers or platform ?? I have good news for you and yes it is 97% possible for you to recover

your money through the help of Gavin ray a recovery specialist ,I lost over €176,000 to fake European broker after paying several fees I didn’t get back my profit and I lost all hope of ever making profit through binary trading until I came across a post online about his Private Hacking and Certified Binary Recovery services i decided to give him a try and i was able to recover my money with his amazing recovery team guidance You can contact him on mail gavinray78@gmail.com or WhatsApp +1 217 339 4023

if you are in financial difficulties or you find it difficult to clear all your bills or you are in big debt because of scammers, now is the time to put an end to all this happenings in your life, we want to introduce you to a real and legit bitcoin investment platform where you can earn 5 times your invested funds weekly and profit are 100% guaranteed for example you invest $500 we are capable to earn $2500 for you in 7 days

Interested Viewers should contact us

via whats-app: +27633586789 or email: wilsontradeszone@gmail.com

to get started

So many people have lost their lives because of the doctor report, doctor is not God and they do not have the final say about your health report so do not believe the doctor, they only say what they know and that is not final. i almost committed suicide because i was told have human papillomavirus and also there is no cure for it, but today i am 100% healed and healthy of doctor Osasu herbal medicine, i have refer several people to this herbal doctor for cure and he has never fail. contact doctor Osasu today on his cure for hpv or hsv and your life will be back again https://drosasusolutionhome.com email address [drosasu25@gmail.com or directly on whasapp +2347064365391 Please share as you read okay, you may save a soul today. Natural herbs are really

I just have to introduce this hacker that I have been working with him on getting my credit score been boosted across the Equifax, TransUnion and Experian report. He made a lot of good changes on my credit report by erasing all the past eviction, bad collections and DUI off my credit report history and also increased my FICO score above 876 across my three credit bureaus report you can contatc him for all kind of hacks . Email him here via Email him here via hackintechnology@gmail.com or whatsapp Number: +1 213 295 1376.

BITCOIN, BINARY OPTION: Please everyone should be careful and stop being fooled by all these brokers and account managers, they scammed me over $200,000 of my investment capital, they kept on requesting for extra funds before a withdrawal request can be accepted and processed, in the end, I lost all my money. All efforts to reach out to their customer support desk had declined, I found it very hard to move on. God so kind I followed a broadcast that teaches on how scammed victims can recover their fund, I contacted the email provided for consultation, I got feedback after some hours and I was asked to provide all legal details concerning my investment, I did exactly what they instructed me to do without delay, to my greatest surprise I was able to recover my money back including my profit which my capital generated. I said I will not hold this to myself but share it to the public so that all scammed victims can get their funds back, ::::::: if you have problems on any stuffed like a bank, company, examinations, database, Social media hacks, Email hacks, Phone hacks, Bitcoin hacks, increased Credit score boost to 800, School result upgrading, Binary option funds recovery Instagram, Bitcoin Mining, WhatsApp, Twitter, Monitor your colleague, access your spouse social media, and a lot more:you can contact him on : wizardwilsonsoftware (@) Yahoo.com his whatsapp number (+1) 807,700,3319. )

How I Got My Ex Husband Back. Am so excited, All Thanks goes to Dr Prince i was married to my husband, and we were living fine and happy. it come to an extend that my husband that use to love and care for me, doesn’t have my time again, until i fined at that he was having an affair with another woman, I tried to stop him all my effort was in-vain suddenly he divorce me and went for the woman. he live me with two of our kids, I cried all day, I was in pains, sorrow and looking for help. I read a comment on how Dr Prince helped a lady to brought her husband back, after 2yrs , He helped people with his Magic spell love and reuniting spell. so I decided to contact him and explain my problems to him, he did a love spell that made my husband to come back to me and never think of the woman. this man is God sent to restore heart break and reunite relationship. may the lord be your strength and continue to use you to save people relationship and any problems contact him for help on princemagicspell@yahoo.com You can also contact him through his WhatsApp or call +18488416266. Contact him now for love spell to bring back your ex lover he is the best spell caster and he is the best solution to all relationship problems…

im greatful wizard wilson for your wonderful masterclass strategy which has help me earn at least $8,000 weekly using his masterclass strategy and has also helped me recover all my lost money in binary options trading, i recommend his help to each traders whose point is to succeed and make good profits in binary options and also for those who wants to get back all their lost money and for those who are new in trading or have any issues in tradings, you can contact him on:

Email: wizardwilsonsoftware (@) Yahoo.com his whatsapp number (+1) 807,700,3319.TESTIFIED:REMEMBER YOUR HAPPINESS IS MY PRIDE

BITCOIN, BINARY OPTION: Please everyone should be careful and stop being fooled by all these brokers and account managers, they scammed me over $9,000 of my investment capital, they kept on requesting for extra funds before a withdrawal request can be accepted and processed, in the end, I lost all my money. All efforts to reach out to their customer support desk had declined, I found it very hard to move on. God so kind I followed a broadcast that teaches on how scammed victims can recover their fund, I visited Cryptorefunder360(at)gmail(dot)com a recovery website, I got feedback after some hours and I was asked to provide all legal details concerning my investment, I did exactly what they instructed me to do without delay, to my greatest surprise I was able to recover my money back including my profit which my capital generated. I said I will not hold this to myself but share it to the public so that all scammed victims can get their funds back, if you have problems on any stuffed like a Recovering Scammed funds, recover your Lost bitcoin, Bitcoin mining, visit Cryptorefuder360(at)gmail(dot)com or whatsapp +13349559030 now and get going.

Making online purchases or investments are becoming increasingly difficult , There are rippers everywhere on the internet looking for whom to take advantage of, I am a victim too. I have been dealing cryptocurrencies for almost a decade , I was introduced to …. as the most profitable investment platforms out there , I could buy cryptocurrencies at 40% discount once I am an investor on the website , It was a good deal for me , I started with 3btc and got my returns and reinvested it on the site , I went all out ,got money to buy more , At my third deal I invested 30btc at the rate of 13000usd/btc .. I was unable to withdraw , trade or access my $390000 worth of btc afterwards, My world was shattered and the banks were ready to take my house , Worst way to get a divorce .. I reported to the police but there was little information for them to start with, one of the officers who became a close friend told me about a private investigation firm here in the United States , He gave me the contact of wizard wilson who i have experienced magic w. that he could help me recover my funds and even trace the culprits if need be , I never believed it until I met him and talked about my situation, He showed me a list and over 150 clients on his catalogue reported a similar situation from different platforms.. I was fortunate to meet him, He is very professional and excellent at his job , He tracked out my profile and traced it out to the master wallet… He confirmed how much I have invested and transferred it to my wallet like it was magic,You can reach the firm from the wizardwilsonsoftware (@) Yahoo.com his whatsapp number (+1) 807,700,3319

My name’s are Elizabeth Harrison from Chicago, IL. I work as a nurse by profession, was earning a little bit okay $3400 monthly, with my two kids I decided that I need to invest, the taught of my investment came after I meant a guy online who makes me feel comfortable and always talk me into self-employed business, I decide to always seek for his advice and he gave me a broker site where I can invest and have profit within a short period of time, I do really trust him but after I invested into the crypto site I discover he was behind everything and I have lost all my savings to him without knowing how he gets into me and lure me with his sweet fuckin words, he ruined my life and I couldn’t be myself anymore. So i decide to seek for help, omg… any attempt i made i get more scammed couldn’t figure out who was real and who wasn’t and at the end of it all i came up with a decision that nothing on the internet is real again. after 2 months i gave up on recovery the money i sent to broker site by bitcoin payment which is up to $65,992 i was on Spotify trying to get some lonely songs for myself when i came across wizardwilsonsoftware (@) Yahoo.com (.) , it sounded real but i was scared to contact him cause it seems i’m not just lucky with making money on investment maybe i had to work through out my whole lifetime so i ignored but i was in a worker meeting when a discussion lead to bitcoin scam and i heard one of my co-worker saying wizard wilson got her funds back and i ask her how she reached him and she gave me this WhatsApp (+1) 807,700,3319 i reached out to Wizard Wilson immediately i got home and we talked for long and i decide to put him to test, to end the whole story, i got more than what i loss on my new blockchain wallet, i was scared at first until he explained to me, a big thanks to the only real recovery hacker online and that’s wizard wilson who i have experienced his magic wizard actually.

Are you having a very low FICO score, and are desperate for a perfect and urgent fix? I confidently recommend CYBER CREDIT GURU. They cleared all negatives, late payments and collections from my credit report and boosted my FICO score from 505 to 800 excellent score, across all three bureaus within four days. CYBER CREDIT GURU does a very neat and perfect job without leaving any form of trace behind. You can give them a trial today and I bet you will never regret it. Contact: CYBERCREDITGURU (AT) GMAIL DOT COM or phone/text: +1 (650) 439 0624

Never met any hacker as discreet and fast like this WHITECOLLAR Hacker. He’s called WHITE and he has helped me in multiple ways first was when my ex wife cheated on me and now he’s helping me paying my credit cards debts plus he helped me gain access to my spouse phone remotely and I was able to use that against him in court. I must say he’s the best at what he do and I recommend him to the world. Email; WhitehatstechATgmailDOTcom , you can be sure to thank me later. I will keep on telling the world that he’s the best out there, I am very thankful because he gave me and my kids a second chance

Never met any hacker as discreet and fast like this WHITECOLLAR Hacker. He’s called WHITE and he has helped me in multiple ways first was when my ex wife cheated on me and now he’s helping me paying my credit cards debts plus he helped me gain access to my spouse phone remotely and I was able to use that against him in court. I must say he’s the best at what he do and I recommend him to the world. Email; WhitehatstechATgmailDOTcom , you can be sure to thank me later. I will keep on telling the world that he’s the best out there, I am very thankful because he gave me and my kids a second chance

I lost my job few months back and there was no way to get income for my family, things was so tough and I couldn’t get anything for my children, not until a met a recommendation on a page writing how Mr Bernie Wilfred helped a lady in getting a huge amount of profit every 6 working days on trading with his management on the cryptocurrency Market, to be honest I never believe it but I took the risk to take a loan of $800 and I contacted him unbelievable and I was so happy I earn $12,500 in 6 working days, the most joy is that I can now take care of my family I don’t know how to appreciate your good work Mr. Bernie Doran God will continue to bless you for being a life saver I have no way to appreciate you than to tell people about your good services.

For a perfect investment and good strategies contact Mr Bernie Doran via WhatsApp :+1(424)285-0682 or Telegram : @Bernie_doran_fx or Email : Bernie.doranfx01@gmail.com

Investing online has been a main source of income that’s why knowledge plays a very important role in humanity you don’t need to over work yourself for money. All you need is the right information and you could build your own wealth from the comfort of your home! Binary trading is dependent on timely signals, assets or controlled strategies which when mastered increases chance of winning up to 90%-100% with trading. It’s possible to earn $10,000 to $20,000 trading weekly-monthly, just file a complaint with George I had almost given up on everything about binary trading and ever getting my lost funds back, till i met with him with his help now i have my lost funds back to my bank account and I can now trade successfully with his profitable strategies and software!! Email: cryptorefunder360(at)gmail(dot)com.

Have you been scammed of money or bitcoin?, if you have, and you choose to let it go then this post isn’t for you. However, if you’d like to recover your lost bitcoin or money, or even expose the perpetrators of such malicious act, then I know just the right person for you, and for the best part it’s free!!’ contact Jake on the details below, be sure to refer to this post to avoid going back and forth.

Contact Jake;

Email: jaketechconsultancy @ gmail.com

Phone: +17319379575

WhatsApp: +17319379575

Hello

We are a trade finance company that uses our own credit lines to facilitate the issuance of financial guarantees like BG, SBLC, DLC and more. If our services will be of help to you, let us know so we can guide you with our process.

Mobile | WhatsApp: +19893413179

Email:mohammedahsan877@gmail.com

I just have to introduce this hacker that I have been working with him on getting my credit score been boosted across the Equifax, TransUnion and Experian report. He made a lot of good changes on my credit report by erasing all the past eviction, bad collections and DUI off my credit report history and also increased my FICO score above 876 across my three credit bureaus report you can contatc him for all kind of hacks . Email him here via Email him here via hackintechnology@gmail.com or whatsapp Number: +1 410 635 0697.

As a novice in the crypto world, I had a wrong transaction and got ripped off by a scammer through an investment scam, I lost about 0.7 btc and 1.5 eth to him. I spoke to a friend who’s a crypto expert and he referred me CLEVERHACKER.HACK@GMAIL.COM, in less than 48 hours after following due procedures by him I got my btc and Eth back, he’s a life saver. You can also text him at (803)814-5462

My name’s are Elizabeth Harrison from Chicago, IL. I work as a nurse by profession, was earning a little bit okay $3400 monthly, with my two kids I decided that I need to invest, the taught of my investment came after I meant a guy online who makes me feel comfortable and always talk me into self-employed business, I decide to always seek for his advice and he gave me a broker site where I can invest and have profit within a short period of time, I do really trust him but after I invested into the crypto site I discover he was behind everything and I have lost all my savings to him without knowing how he gets into me and lure me with his sweet fuckin words, he ruined my life and I couldn’t be myself anymore. So i decide to seek for help, omg… any attempt i made i get more scammed couldn’t figure out who was real and who wasn’t and at the end of it all i came up with a decision that nothing on the internet is real again. after 2 months i gave up on recovery the money i sent to broker site by bitcoin payment which is up to $65,992 i was on Spotify trying to get some lonely songs for myself when i came across wizardwilsonsoftware (@) Yahoo.com (.) , it sounded real but i was scared to contact him cause it seems i’m not just lucky with making money on investment maybe i had to work through out my whole lifetime so i ignored but i was in a worker meeting when a discussion lead to bitcoin scam and i heard one of my co-worker saying wizard wilson got her funds back and i ask her how she reached him and she gave me this WhatsApp +1(321) 621_1089 i reached out to Wizard Wilson immediately i got home and we talked for long and i decide to put him to test, to end the whole story, i got more than what i loss on my new blockchain wallet, i was scared at first until he explained to me, a big thanks to the only real recovery hacker online and that’s wizard wilson who i have experienced his magic wizard actually.

It’s A SPLASH SPLASH JOB AGAIN!!!

WIZARD BRIXTON HACKER CONFIRMS WORK done before WORKMANSHIP is paid. Excellent Customer Service AND A 100% Guarantee.

BEWARE OF FRAUDSTERS

If you have been a VICTIM,

Contact:

Cell number-: (+1- /807-23 ) 4-0428

EMAIL : WIZARDBRIXTON(AT) GMAIL (DOT) COM for Directives.

Here, It’s always a win for you.

Without any Reasonable doubt, it is no News that WIZARD BRIXTON HACKER INTEL offers one of the best Hacking Services World Wide.

CONTACT US FOR ALL TYPES OF HACKING JOB We provide professional hacking services, we provide the following services.

-University grades change

-Hack bank accounts

– Delete criminal record hack

-Facebook hack

– Hack Twitter

-Hack email accounts

-Hack for note changes

Website crashed hack

-Server crashed hack

-Skype hack

-Hack databases

-Hack WordPress blogs

– Hack individual computers

– Hack devices remotely

-Burner number

-Verified PayPal Accounts Hack

– Any social media account hack

-Android and iPhone hack

-Hack to intercept SMS

– Email intercept hack

-Bitcoin recovery

-binary multiplication

-Credit Score Upgrade

– Track call log and spy call recording.

Remotely monitor SMS text messages.

Cell phone GPS location tracking. Spy on WhatsApp messages.

-Not discoverable IP etc.

Contact us at wizardwilsonsoftware@Yahoo.com his whatsapp number +1 (321) 621_1089

For further questions..

➡️BE NOT TROUBLED anymore. you’re at the right place. Nothing like having trustworthy hackers. have you lost money before or bitcoins and are looking for a hacker to get your money back? You should contact us right away. It’s very affordable and we give guarantees to our clients. Our hacking services are as follows:

Email:Creditcards.atm@gmail.com

➡️-hack into any kind of phone

➡️_Increase Credit Scores

➡️_western union, bitcoin and money gram hacking

➡️_criminal records deletion_BLANK ATM/CREDIT CARDS

➡️_Hacking of phones(that of your spouse, boss, friends, and seeing whatever is being discussed behind your back)

➡️_Security system hacking…and so much more. Contact THEM now and get whatever you want at

Email:Creditcards.atm@gmail.com

➡️★ OUR SPECIAL SERVICES WE OFFER ARE:

➡️* RECOVERY OF LOST FUNDS ON BINARY OPTIONS

➡️* Credit Cards Loading {Any country}

➡️* BANK Account Loading {Any country}

➡️★ You can also contact us for other Cyber Attacks And Hijackings, we do All ★

➡️★ CONTACTS:

➡️* For Binary Options Recovery,feel free to contact (Creditcards.atm@gmail.com)for a wonderful job well done,stay safe.

I couldn’t believe a well reputable company can be so wicked to restrict my withdraws ,after so much pressure on me due to the large amount already invested at a point I wanted to give up and admit I’m a loser but then i saw a review about crypto heist recovery how good and helpful they have been to traders I contacted them and I got my whole bitcoin back within 72hrs ,talk about bitcoin recovery expert then you mention “{CRYPTOHEISTRECOVERY DOT COM}”

WHATSAPP: +1 904 289 2594

Waow this is unbelievable, it is my first time to be carried away by such a high profile article, I will immediately contact you directly and also to take the advantage to share some latest information about FAKE MALAYSIAN PASSPORT

I lost my job few months back and there was no way to get income for my family, things was so tough and I couldn’t get anything for my children, not until a met a recommendation on a page writing how Mr Bernie Wilfred helped a lady in getting a huge amount of profit every 6 working days on trading with his management on the cryptocurrency Market, to be honest I never believe it but I took the risk to take a loan of $1000. and I contacted him unbelievable and I was so happy I earn $12,500 in 6 working days, the most joy is that I can now take care of my family I don’t know how to appreciate your good work Mr. Bernie Doran God will continue to bless you for being a life saver I have no way to appreciate you than to tell people about your good services. For a perfect investment and good strategies contact Mr Bernie Doran via WhatsApp :+1(424)285-0682 or Telegram : @Bernie_doran_fx or Email : Bernie.doranfx01@gmail.com

My husband and I have been married for about 7 yrs now. We were happily married with two kids, a boy and a girl. 3 months ago, I started to notice some strange behavior from him and a few weeks later I found out that my husband is seeing someone. He started coming home late from work, he hardly cared about me or the kids anymore, Sometimes he goes out and doesn’t even come back home for about 2-3 days. I did all I could to rectify this problem but all to no avail. I became very worried and needed help. As I was browsing through the Internet one day, I came across a website that suggested that Dr OKU can help solve marital problems, restore broken relationships and so on. So, I felt I should give him a try. I contacted him and he did a spell for me. Two days later, my husband came to me and apologized for the wrongs he did and promised never to do it again. Ever since then, everything has returned back to normal. My family and I are living together happily again.. All thanks to Dr OKU. If you need a spell caster that can cast a spell that truly works, I suggest you contact him. He will not disappoint you. This is his Email: (okutemple@gmail.com) or WhatsApp him (+2348163425519)

Hello everyone my name is lucky Clark i am from U.K i’m giving a testimony on how I joined the illuminati brotherhood, I was trying to join this organization for so many years now, I was scammed by fake agent in south Africa and Nigeria, I was down i could not feed my self and my family anymore and I tried to make money by all means but all in vain, I was afraid to contact any illuminati agent because they have eat my money, one day I came across a post of someone giving a testimony thanking a man called Charles Anthony for helping him to join the illuminati brotherhood, then I looked at the man’s email and the phone number that was written there, I was afraid to contact him because i was scammed a lot of times by scammers who ate my 5000,000 and went away with the money then I was very confused so I decided to contact the person that was given the testimony and i called him and I communicated with him on phone calls before he started telling me his own story about when he wanted to join he told me everything to do, then I made up my mind and called the agent called Charles Anthony and he told me everything to do and I was initiated, surprisingly I was given my benefit of being a new member of the great illuminati brotherhood I was so happy, for those of you trying to join this organization this is your opportunity for you to join CONTACT MR Charles Anthony call .(+2348119132137) or WhatsApp him (+2348119132137) or Email johnwilliam22131@gmail.com……

IS IT POSSIBLE TO ACTUALLY GET BACK FUNDS LOST TO CRYPTOCURRENCY SCAM? ABSOLUTELY YES! BUT, YOU MUST CONTACT THE RIGHT AGENCY TO ACHIEVE THIS.

Recovery Precinct is a financial regulator, private investigation and funds recovery body. We specialize in cases concerning cryptocurrency, FAKE investment schemes and recovery scam.

Visit WWW. RECOVERYPRECINCT. COM now to report your case or contact our support team via the contact information below to get started.

? RECOVERYPRECINCT (@) G MAIL . COM

Stay Safe !

CONTACT US FOR ALL KINDS OF HACKING JOBs @ We offer professional hacking services,we offer the following services;

-University grades changing

-Bank accounts hack

-Erase criminal records hack

-Facebook hack

-Twitters hack

-email accounts hack

-Grade Changes hack

Contact us on whatsapp + 1 681 532 3704

Email- n17833408@gmail.com

I really appreciate the detail of your forecasts. I share the same passion for snowstorms and now use you as my main source of information. You have also as you have proved most accurate. I continue to refer you to others who are equally impressed. Thank you for your blog! BUY REAL NCLEX CERTIFICATE ONLINE WITHOUT EXAMS

I’m so happy to share this with you that can read / see this now. When I started trading binary and forex a few months ago, I really didn’t have the necessary tools to trade and I lost a lot until I met Pablo Martinez who taught me all about market psychology as he managed my account for me. Today I am grateful to him for his great offer and help because it really changed my financial situation with an investment capital of $1500 and now I’m earning around $35,500 – $30,000 profits per week. Here is his WhatsApp no: +44 7520 636249 or his email address: pm7234029@gmail.com

I Got my ATM Card from Digital Card Hacker’s Can’t just appreciate ☝☝you enough,, digital Card Hacker has been a good help to me and I am doing great right now i order ATM Card of $50,000 which where deliver to me in my country with the password, i use the ATM CARD withdraw it’s work for me like magic You can also contact them for the service below * Western Union/MoneyGram Transfer Hack * Bank Transfer Hack * PayPal / Skrill Transfer Hack * Crypto Mining Hack *** CashApp Transfer Hack Email: digitacardhacker@gmail.com Text & Call or WhatsApp: +1(321)779-7817

Good news!!! Good news!!!

HAIL LIGHT!

Do you want to Be WEALTHY AND POWERFUL IN LIFE? Do you want to get Rich in a little time?Do you want the world to recognize you and listen to you when you speak? do you want to be in power and control? if yes, Be a part of the world most Capable brotherhood of Wealth and Power – The Illuminati Freemason-

If You Have Sickness or Affliction Of Any Kind Or Any Level, no matter how severe it is, Contact Us today for your liberation to health And Wholeness

ELEVATE YOURSELF FROM POVERTY AND FREE YOURSELF FROM THE BONDAGE OF SICKNESS WITH SPIRITUAL ATTACKS

Do not hesitate to contact us If We’ll Be Of Help To YOU in any ways or at any situation you find yourself.

Here’s our contact info

EMAIL/hangout: illuminatiinitiationtemplewa@gmail.com (Supreme Agent Of Light)

DIRECT SMS/WhatsApp / Calls To Masonic Registry +1(760)8922577

WARNING: only those who are interested to become a member of the church of Satan are allow to visit office or send a mail to the email address below. Do not contact if you are not interested and once you contact there is no going back. so think before contacting. BEWARE!!!

BE SURE THAT YOUR HEART DESIRES WILL COME THROUGH BECAUSE THAT IS WHAT WE ARE HERE FOR, making your dreams and wish come to REALITY.

HAIL LIGHT!

i was a victim of scam whereby i lost all my saving to the scammer, i was into depression cause i found myself losing my saving to a scammer all because i want to earn more. For a long time i searched for help. during this time it was not easy living. But it didn’t last long as Adam Wilson came into my life and change my financial problem. He helped me recover my money from the scammer without asking for an upfront payment. If there is other ways to appreciate them more than paying their service fee which i paid after money was fully recovered to me and writing a short article about them then i will. Am writing this out here cause of the victims who are yet to get help, victims around the world have the right to get access their help. You can reach him on adamwilson. trading at consultant DOT Com

Hello everyone, are you interested to trade with Bitcoin Investment or you are looking for an expert to trade and manage your account for you or Do you have funds you wish to withdraw from your binary broker? or you are having problems with the withdrawing of your funds and you don’t know how to go about it. Kindly get in touch via adamwilson.trading@consultant.com / What’> APP; ㈩➀➇➆⓿➂➃➄➆➈➂➆ , and he will guide you on how to get back your funds within 24hours, because his strategy really helped me to withdrawal my funds that was stuck in my trading account! All thanks to him I’m forever grateful…

THIS IS A “MUST READ” FOR ALL CRYPTO CURRENCY SCAM VICTIMS AND EVERYONE BATTLING WITH POOR CREDIT SCORE.

WHAT IS THE TENDENCY OF ACTUALLY GETTING BACK FUNDS LOST TO CRYPTOCURRENCY SCAM? ABSOLUTELY POSSIBLE. DO YOU DESIRE CREDIT REPAIR?(TRANSUNION, EQUIFAX, EXPERIAN)? YOU MUST CONTACT THE RIGHT AGENCY TO ACHIEVE THIS. www recoveryprecinct com

Recovery Precinct is a financial regulator, private investigation and funds recovery body. We specialize in cases concerning ethical hacking, cryptocurrency, FAKE investment schemes and recovery scam. We are also experts in credit repair.

Visit www recoveryprecinct com now to report your case or contact our support team via the contact information below to get started.

? recoveryprecinct @ gmail com

Stay Safe !

Are you in need of hacking services or faced with delays and unnecessary excuses from fake hackers on your job? Worry no more,we are here for you,we will give you the best result without stress.We are professional hackers, what hacking services do you need? We will render it with swift response and no trace, your job is 100% guaranteed.Contact us at unlimitedhackword@gmail.com or WhatsApp +14705241036 for more information. Our services includes:

*School grade hack,

*hack into email accounts,

*all social media accounts,

*Recover your lost cryptocurrencies

*School database to clear or change grades,

*Erase criminal records

*Company records and systems,

*Bank accounts,

*Iphone Hack

* Credit cards hacking,

*Website crashed hack

* Credit score hack,

* Monitor your partners phone, etc..

Thanks.

my husband was cheating and had always got away with it because i did not know how or always too scared to pin anything on him. with the help a friend who recommended me to who help hack her phone,email, chat, sms and expose him for a cheater he is. I just want to say a big thank you to Ethicalhackers009@gmail.com . am sure someone out there is looking for how to solve his relationship problems, you can also contact him for all sorts of hacking job..he is fast and reliable. you could also text +14106350697(whatsapp) contact and thank me later.

HAIL LIGHT!

Do you want to Be WEALTHY AND POWERFUL IN LIFE? Do you want to get Rich in a little time?Do you want the world to recognize you and listen to you when you speak? do you want to be in power and control? if yes, Be a part of the world most Capable brotherhood of Wealth and Power – The Illuminati Freemason-

If You Have Sickness or Affliction Of Any Kind Or Any Level, no matter how severe it is, Contact Us today for your liberation to health And Wholeness

ELEVATE YOURSELF FROM POVERTY AND FREE YOURSELF FROM THE BONDAGE OF SICKNESS WITH SPIRITUAL ATTACKS

Do not hesitate to contact us If We’ll Be Of Help To YOU in any ways or at any situation you find yourself.

Here’s our contact info

EMAIL/hangout: illuminatiinitiationtemplewa@gmail.com.

DIRECT SMS/Calls To Masonic Registry +1(760)8922577

WHATSAPP +2347052719658.

WARNING: only those who are interested to become a member of the church of Satan are allow to visit office or send a mail to the email address below. Do not contact if you are not interested and once you contact there is no going back. so think before contacting. BEWARE!!!

BE SURE THAT YOUR HEART DESIRES WILL COME THROUGH BECAUSE THAT IS WHAT WE ARE HERE FOR, making your dreams and wish come to REALITY.

HAIL LIGHT!

I was scammed by an Instagram person faking a celebrity i talked with this scammer 8 months via WhatsApp and I sent money to them via Bitcoin then I was cohered to give my banking login and from there they hustled me out of my 20k from the unemployment money they said oh I routed money to your account and never gave me time to verify that was my unemployment money. They were really patient with me and waited 8 months for my payment then I exposed them…by video on WhatsApp. They asked me to bitcoin the money via atm. But for the timely intervention of Mr. Wizard Brixton, who just in kick-off on time got back my $20,000. He is really good at what he does, I have recommended him to friends and co-workers who all became satisfied customers. He has helped me a lot in the trading industry, you can reach him at WIZARDBRIXTON AT GMAIL DOT COM for Everything. Hacking and Funds Recovering he is the best and has different skills in funds recovering and exposing scammers. Am glad and happy to recover back my money (WIZARDBRIXTON)AT GMAIL DOT COM WhatsApp +1 807 234 0428 You can also text or call +1 807 234 0428

My humble regards to everyone reading comments on this platform and a great thanks to the admin who made this medium a lively one whereby everyone can share an opinion, I am Mrs. Walter Dolores, from Montana, United States. I’m a nurse by profession, I had a serious health issue that took me 8 months to get back to work, during this period of eight months I came across an advert with a lot of good comments under the trading broker platform. I was very interested so I decided to contact the trading platform and invest with them, after my first deposit I was told there is an increase in buying stocks so I had to send another money and this whole thing continued for a good 6 months. before I could realize I was already bankrupt when I discovered that I have been scammed for a total sum of $357,890, I tried to get some recommended hackers online but I ended up getting scammed of an additional $35k, it hurts me so much, I already gave it up but then I came in contact with wizardharry (@) programmer (.) Net who I also message directly via What sApp (+1) (807) 808? 6168 and he responded to me urgently and helped me to get back all my funds, everything was sent to me at once. Wizard Harry proves to me that scammed crypto can be recovered. All thanks to Wizard Harry.

The UK Cryptocurrency Recovery, Lost BTC Recovered;

What To Do When You Fall Victim To A Crypto Scam.

Hello, My name is Ali Syed .

I’m a Urologist in Birmingham,

I do online trading,

I was a scam victim Ultimate Hacker Jerry recovered my Bitcoins amazingly.

Did you also lose your cryptocurrency to fake online investments like I once did? or to the wrong wallet? Quickly get in touch with Ultimate Hacker Jerry if you want to recover your funds or get some legal counsel on how to go about it. I lost more than 7.18 BTC to an online investment scam. I was promised to get 25% of my investment every month, and I fell for it. That’s how I got scammed. Luckily, after a long search for how to recover it, I found a post from Wilder Newton’s Local News about Ultimate Hacker Jerry. Immediately, I contacted him at (Ultimatehackerjerry @ seznam. cz) and I trusted him enough because his reviews were from our local news site Wilder Newton. And within 4 hours of contacting him, I got all my funds back with an ROI. It was unbelievable. I must state, I had to send out my review also. He’s indeed recommendable.

You can also WhatsAp jerry at +1.52.03.29.03.2.0

Visit ULTIMATE HACKER JERRY

Ma Sha Allah

Contact him for any type of hacking, he is a professional hacker that specializes in exposing cheating spouses, and every other hacking related issues. he is a cyber guru, he helps catch cheating spouses by hacking their communications like call, Facebook, text, emails, Skype, whats-app and many more. I have used this service before and he did a very good job, he gave me every proof I needed to know that my fiancee was cheating. You can contact him on his email to help you catch your cheating spouse, or for any other hacking related problems, like hacking websites, bank statement, grades and many more. he will definitely help you, he has helped a lot of people, contact him on, Henryclarkethicalhacker@gmail.com, and you can Text/Call &WhatsApp: +1 (262)-236-7526, and figure out your relationship status. I wish you the best.

I’m excited to write about Henry Hacker, he is a great and brilliant hacker who penetrated my spouse’s phone without a physical installation app. And I was able to access my spouse’s phone, SMS, Whatsapp, Instagram, Facebook, Wechat, Snapchat, Call Logs, Kik, Twitter and all social media. The most amazing thing there is that he restores all phone deleted text messages. And I also have access to everything including the phone gallery without touching the phone.I can see the whole secret of my spouse. Contact him for any hacking service. He is also a genius in repairing Credit Score, increasing school grade, Clear Criminal Record etc. His service is fast. Contact:, Henryclarkethicalhacker@gmail.com and on whatsapp him on +1262–236–7526…

I’m excited to write about Henry Hacker, he is a great and brilliant hacker who penetrated my spouse’s phone without a physical installation app. And I was able to access my spouse’s phone, SMS, Whatsapp, Instagram, Facebook, Wechat, Snapchat, Call Logs, Kik, Twitter and all social media. The most amazing thing there is that he restores all phone deleted text messages. And I also have access to everything including the phone gallery without touching the phone.I can see the whole secret of my spouse. Contact him for any hacking service. He is also a genius in repairing Credit Score, increasing school grade, Clear Criminal Record etc. His service is fast. Contact:, Henryclarkethicalhacker@gmail.com and on whatsapp him on +1262–236–7526….

Recovering lost Bitcoin can require unique hacking skills and expertise that are possessed by only a handful of professional hackers. While there are many recovery websites out there, it’s important to be cautious as 99% of them are operated by scammers who try to appear legitimate. Instead, it’s best to seek out a trusted hacker like Genuine Hackers who can help you recover your funds. They were able to recover $100k worth of BTC that I had lost to bitcoin mining. To get in touch with Genuine Hackers, you can email them at GENUINEHACKERS000@GMAIL.COM or message them on WhatsApp at +1 (260) 218-3592.

MYSTERIOUS HACKER Crypto Recovery Solutions, is a reputable crypto currency recovery hacker that help me to recover my lost crypto currency, am proud to announce to the public this cryptocurrency recovery hacker. This revolutionary solution is designed to help individuals and businesses reclaim lost digital assets following instances of cybercrime targeting cryptocurrency and Forex trading. Other than forex trading stolen crypto recovery services, MYSTERIOUS HACKER also offers tracing services to assist in tracking down the source of the theft and resolving issues with wallets. This hacker comprehensive updates and teaching resources to help clients prevent future cryptocurrency losses.contact them by Email: mysterioushack666@cyber-wizard.com

WERE YOU SCAMMED THROUGH FAKE CRYPTO INVESTMENTS?

I was lucky to come across AstraWeb Cyber Security Network, which was able to recover my stolen Bitcoin worth $704,000 after I was scammed by a fake cryptocurrency investment platform.

I was very naive and was taken advantage of when I was contacted by a scammer who told me I could earn huge profits from my investment, I started with an initial investment of $1,500 and it went on and on until it was time to withdraw my profits and I discovered I have been scammed.

I was depressed and hurt but I’m glad I came across AstraWeb Cyber which was able to trace and recover my stolen Bitcoin.

If you ever wondered if it was possible to recover lost or stolen cryptocurrencies, yes it is possible with the right resources and information. I’m truly grateful AstraWeb that they were able to help me get my money back. They are very professional and their service is excellent.

Their contact information is written below

E-mail: AstraWeb@cyberdude . com

Website: www . astrawebcybersecurity . net

I’m hugely indebted to their excellent team and magnificent work. The best cryptocurrency recovery team and I’m highly recommending their services.

Retrieving Lost BTC from Scammers by Recovery Masters

Hey there, I just want to testify of the wonders of a Crypto Recovery Agency Recovery Masters I was going on the net as always with the little time I get during my lunch break time being a nurse. A pop-up ad came on my screen which then clicked, it was about Cryptocurrency mining and investment schemes. I read through the ad, it was really convincing as I read multiple reviews from people who had benefited massively from this Crypto scheme. I got interested in it, it was fast, easy, and won’t affect my job. My first investment was $2,020.00 BTC which generated a profit of $28,000.00. They always asked me to invest to get to a certain level so I could access my investments till I had invested all I had and was borrowing. I had already invested $ 88,000.00 USDT in total and still wasn’t able to withdraw a penny from my investments or profits. I got bored of everything, told them I am no longer interested, and that’s the last I heard from them. I was really scared as I thought I had lost my money. I was referred by my co-worker to this team of Hackers Recovery Masters,their terms for recovering my lost BTC were conducive and I quickly engaged his services to help me retrieve my BTC. This guy retrieved my lost $88,000.00 totaled without any hassle. Contact them to recover your lost BTC or money on support email (support@lostrecoverymasters.com ) 0r WhatsApp (+1(204)8195505)

Learn More: https://lostrecoverymasters.com/

My name is Winfield Biermann from Germany i am a victim of crypto currency scam, i know how frustrating it is to loose bitcoin to a fraudulent online investment platform, when i fell prey to online scam, all thanks to my friend who recommended MYSTERIOUS HACKER to me, their assessments were quite good and trustworthy, MYSTERIOUS HACKER a qualified cryptocurrency expert,assist client who lost their bitcoin to retrieve their funds back to their wallet, MYSTERIOUS HACKER miraculously restored my wallet and all of my bitcoins within 48 hours, with high confidence i urge you to contact MYSTERIOUS HACKER now for them to help you retrieve your bitcoin from scammers, the good thing is that there is no upfront payment, email them on : mysterioushack666@cyber-wizard.com

I’m Miss Marie H Anderson, from FLORIDA TALLAHASSEE, United States of America. I am a single Mom of two Kids’ I was deceived by a guy who I met on social media he made me believe that he could help me invest well and earn a profit within a short period that could get me a house so I entrusted all my savings into the trading stock platform, only for me to find out after 5 months the site shut down and the guy is nowhere to be found, he scammed me, I was at the point of committing suicide when I read an article about (brunoequickhack AT GMAil.com) Crypto Recovery Service and I reached out to them, with their service I got a

https://brunoequickhack.wixsite.com/my-site lost back within 72 hours all thanks to Brunoe Quickhack. ions

Numerous choices made by eminent investors caused many of them to end up in the wrong hands. I was previously a victim as well after being convinced to deposit $90,000 in an untrue investment website. However, after learning that everything was a hoax, I was in disbelief. Since all of this cash was my own hard-earned money, I nearly gave up. The real truth was a recommendation of Pro Wizard Gilbert Recoveryfrom a companion. In a matter of 72 hours, I was able to get my money back. The Pro Wizard Gilbert Recovery team deserves the utmost praise since they were fantastic. Pro Wizard Gilbert Recovery is accessible to help you the most if you need a collaborative hacking team. Here is a contact information: Contact: prowizardgilbertrecovery(@)engineer.com also, visit their website: prowizardgilbertrecovery.xyz

I was so dissatisfied to carry out necessary probing but i really wanted to leap on the crypto trading and investment aim. Unfortunately for me, I invested 53,450 GBP worth of bitcoin with a fraudulent company. I was delighted to observe my account increase to 230,200 GBP within a couple of weeks. But i didn’t realize i was dealing with a diddle company, until i tried to make an attempt to withdraw. I made a withdrawal request, and noticed my account was suddenly blocked for no apparent reason. I tried contacting their customer support, but all to no avail. I needed my money back at all cost, because I couldn’t afford to let it go. So i tried all possible means to make sure i recovered my scammed bitcoin. I did a lot of online search for help, and tried to see if there were other people who had any similar experience. I stumbled upon a cryptocurrency forum were a couple of people mentioned that they had been through the same process but were able to recover their lost cryptocurrency, funds with the help of CryptocyberNet at gmailcom. So i file a report and he was able to help me get back all my lost funds within 1 week i feel indebted to him. Apart from trying to express my gratitude to them once again using this medium, I will commend anybody who wants to recover scammed bitcoin, stolen cryptocurrency, funds lost to binary options forex, investment and any other form of online scam reach out to CryptocyberNet @ gmail . Com

Mi nombre es Michael. Si soy honesto, algunas de estas personas en línea que publican sobre la imposibilidad de recuperar criptomonedas (Bitcoin) también podrían ser estafadores. ¡Los mismos que no quieren que les arrebaten sus recursos adquiridos ilegalmente! Piénsalo. Mucha gente ha recuperado su riqueza, pero un número casi igual de personas intenta demostrar que esto es imposible: un complot bastante agradable e inteligente. Dos amigos y yo recuperamos nuestras criptomonedas. Considero que compartir los detalles de la cantidad involucrada y la historia más profunda es bastante excesivo, pero mi punto y mensaje es que logré recuperar mi Bitcoin a través de un hacker. Se llaman Exner Pro Hacker. Comparten un correo electrónico similar, Exnerprohacker@protonmail.com. No se desanime por los rumores en línea, pruébelo usted mismo. Lo bueno es que siempre tienes el control y la ventaja durante todo el proceso.

I got myself involve in trading with an unregulated binary option broker company , my total asset was withheld for no reason, I paid several fees for this but still couldn’t get my funds, I had to file a case report to Gavin ray a well known recovery specialist who help in recovering back all scammed crypto from any scam companies provided you have the right information, he was able to restore all my asset .get in touch with Gavin on mail Gavinray78@gmail. com or WhatsApp +1 352 322 2096, he’s highly recommended.

I want to express my gratitude to BRUNOE QUICK HACK for their outstanding cryptocurrency recovery services. Losing access to cryptocurrency assets can be a distressing experience, but you don’t have to face it alone. The expert team at Brunoe Quick Hack is here to assist you in recovering your lost funds. My name is Karina Taylor, I reside in Jacksonville, Florida, with my wife and four children. brunoequickhack ”'” AT” GMAIL””DOT”” COM” In the challenging year of 2020 amid the pandemic, we faced a major setback that resulted in the closure of all our businesses and substantial financial losses. Left with little recourse, we opted to invest the remaining funds in a cryptocurrency platform given its remote nature. Regrettably, we became victims of a broker scam that disappeared with our investment. Our luck changed when we stumbled upon brunoequickhack””.com on WhatsApp at (+) 1 7.0.5. 7.8.4.2.6.3.5. Within just 72 hours, they successfully recovered the scammed funds, providing us with a glimmer of hope.